pa inheritance tax exemption

A rate of six percent applied to assets that passed to so-called lineal descendants such as children grandchildren and. Furthermore this exemption can be taken as a deduction on line 3 of Schedule H of the Pennsylvania Inheritance Tax Return Form REV-1500.

Estate Tax Planning Post Atra Ward And Smith P A

Inheritance of Farm Exempt from Pennsylvania Inheritance Tax.

. To exempt inheritanc ny other a e statute d the broth estors and oing and t r legal ado ame family was claime of Revenue the seven f agricultur any year e been paid ents death tatepaus mily. REV-720 -- Inheritance Tax General Information. In todays society running an agricultural business is no easy.

Pennsylvania has an Inheritance Tax that applies in general to transfers resulting from a persons death. As shown on REV-1500 Pennsylvania Inheritance Tax Return. This year Pennsylvania is eliminating the inheritance tax for small businesses that remain in the family.

Lets say that when you die your leave your home and investments to your. While the Pennsylvania inheritance tax can take a bite out of your estate it is rarely devastating. By Kevin Pollock July 5 2012 Farm Inheritance Tax 相続税 Pennsylvania.

The federal estate tax exemption is 1170. If you have any questions about the. What is the family exemption and how much can be claimed.

0 percent on transfers to a surviving spouse to a parent from a child aged 21 or younger and to or for. Under a new Pennsylvania law there. Summary of PA Inheritance Tax PA is one of the few states that still has an inheritance tax NJ also has inheritance tax Most states adopted a pick-up tax tied to the federal state death tax.

Traditionally the Pennsylvania inheritance tax had two tax rates. The tax rate depends on the relationship of the recipient to the decedent. The family exemption is a right given to specific individuals to retain or claim certain types of a decedents property in.

Pennsylvania Inheritance Tax Safe Deposit Boxes. Act 52 of 2013 HB 465 signed into law by the Governor on July 9. REV-1197 -- Schedule AU.

Is exempt from inheritance. The rates for Pennsylvania inheritance tax are as follows. There is still a federal estate tax.

The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania. There is a federal estate tax that may apply and Pennsylvania does have an inheritance tax. Act 85 of 2012 created two exemptions the business of agriculture 72 PS.

REV-714 -- Register of Wills Monthly Report. This exemption from inheritance tax can be applied to any persons estate where the decedent passed away after June 30 2012. Recently Pennsylvania enacted a new law that allows the transfer of a Qualified Family-Owned Business Interest QFOBI to one or more Qualified Transferees without being subject to.

How many inheritance tax exemptions are available pursuant to Act 85 of 2012. File Number Enter the file number of the estate assigned by the Register of Wills as shown on REV-1500 Pennsylvania. If there is no spouse or if the spouse has forfeited hisher rights.

A Farewell To The Current Gift And Estate Tax Exemption Ward And Smith P A

Estate And Inheritance Taxes Urban Institute

Pennsylvania Inheritance Tax Agriculture Family Business Exemptions

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts Estate And Trust Tax Return Preparation

Do I Need To Pay Inheritance Taxes Postic Bates P C

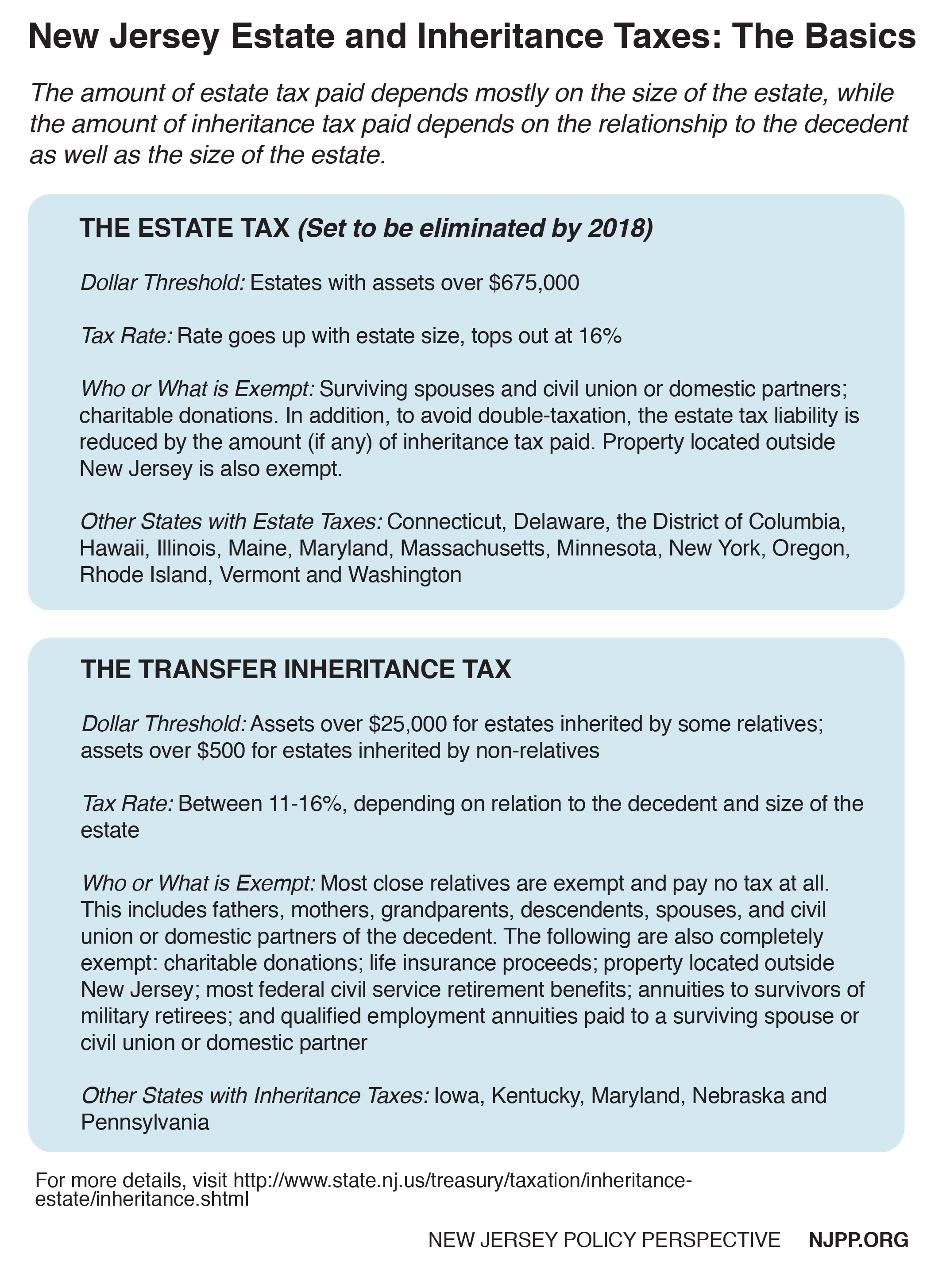

Fairly And Adequately Taxing Inherited Wealth Will Fight Inequality Provide Essential Resources For All New Jerseyans New Jersey Policy Perspective

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Update Minnesota Estate Tax Exemption Fafinski Mark Johnson P A

Who Pays Pennsylvania Inheritance Tax

Fill Free Fillable Forms For The State Of Pennsylvania

Pa Inheritance Tax Primer No Changes For 2017 Elder Law Pennsylvania

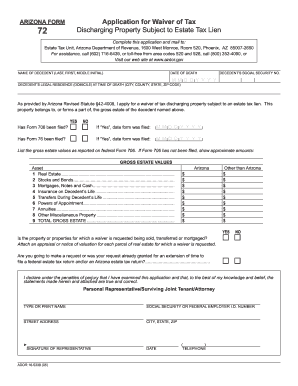

Arizona Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

How Much Is Inheritance Tax Community Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Death And Taxes Part Ii State Taxes On Pasture

State Taxes On Inherited Wealth Center On Budget And Policy Priorities